How to Calculate Sales Profit Margin: A Clear and Confident Guide

Calculating sales profit margin is a crucial aspect of running a successful business. It helps to determine how much profit a company has made on each sale, and whether the business is profitable overall. Sales profit margin is the percentage of revenue that remains after all costs and expenses have been deducted. It is an essential metric for measuring the financial health of a business.

To calculate sales profit margin, a company needs to know its total revenue, cost of goods sold, and other expenses. The formula for calculating sales profit margin is straightforward: subtract the total cost of goods sold and other expenses from the total revenue, and then divide the result by the total revenue. The resulting percentage is the sales profit margin.

Knowing how to calculate sales profit margin is critical for businesses of all sizes. By calculating this metric regularly, companies can identify areas where they need to improve efficiency, reduce costs, or increase revenue. This article will provide a step-by-step guide on how to calculate sales profit margin, as well as tips for improving profit margins and maintaining financial stability.

Understanding Profit Margin

Definition of Sales Profit Margin

Profit margin is a financial metric used to measure a company's profitability. It is calculated by dividing the net income by the revenue generated by the company. The result is expressed as a percentage. Profit margin is an important measure of a company's financial health and is used by investors, analysts, and business owners to evaluate the company's performance.

Sales profit margin, also known as gross profit margin, is a measure of the profitability of a company's sales. It is calculated by subtracting the cost of goods sold (COGS) from the revenue generated by the sales and then dividing the result by the revenue. The result is expressed as a percentage. Sales profit margin is an important measure of a company's ability to generate profits from its sales.

Importance of Profit Margin in Business

Profit margin is an important metric for businesses because it provides insight into the company's financial health. A high profit margin indicates that the company is generating a healthy profit from its sales. A low profit margin, on the other hand, indicates that the company is struggling to generate profits from its sales.

Profit margin is also important because it allows businesses to compare their performance to that of their competitors. By comparing profit margins, businesses can identify areas where they may be lagging behind their competitors and take steps to improve their performance.

In addition, profit margin is an important metric for investors because it provides insight into the company's ability to generate profits. Investors use profit margin to evaluate the company's financial health and make investment decisions.

Overall, understanding profit margin is essential for businesses and investors alike. By monitoring profit margin and taking steps to improve it, businesses can improve their financial health and generate more profits from their sales.

Calculating Sales Profit Margin

Components of the Profit Margin Formula

Sales profit margin is a profitability ratio that measures how much profit a company makes for every dollar of sales revenue. To calculate sales profit margin, you need to know two components of the formula: net income and revenue. Net income is the total profit a company earns after deducting all expenses, including taxes. Revenue is the total amount of money a company earns from sales.

Step-by-Step Calculation Process

To calculate sales profit margin, follow these simple steps:

- Determine the net income of the company. This can be found on the income statement of the financial statements.

- Determine the revenue of the company. This can be found on the income statement of the financial statements.

- Divide the net income by the revenue to get the profit margin.

The formula for calculating sales profit margin is:

Sales Profit Margin = (Net Income / Revenue) x 100%

For example, if a company has a net income of $100,000 and revenue of $500,000, the sales profit margin would be:

Sales Profit Margin = ($100,000 / $500,000) x 100% = 20%

This means that for every dollar of sales revenue, the company earns 20 cents of profit.

It is important to note that sales profit margin can vary widely across different industries and companies. Some industries, such as retail, typically have lower profit margins, while others, such as technology, may have higher profit margins. It is also important to compare a company's profit margin to its competitors and industry averages to get a better understanding of its financial health.

Analyzing Profit Margin

Interpreting Profit Margin Results

Once you have calculated your profit margin, it is important to interpret the results correctly. A high profit margin is generally a positive sign, as it indicates that a company is generating a significant amount of profit relative to its revenue. However, it is important to consider the context in which the profit margin was achieved. For example, a company may have a high profit margin because it charges significantly higher prices than its competitors, which may not be sustainable in the long term.

On the other hand, a low profit margin may indicate that a company is struggling to generate a profit, which could be a cause for concern. However, it is important to consider the reasons behind the low profit margin. For example, a company may be investing heavily in research and development or marketing, which could be reducing its short-term profitability but could lead to higher profits in the future.

Comparing Profit Margins Across Industries

When comparing profit margins across different industries, it is important to consider the unique characteristics of each industry. For example, some industries may have higher profit margins due to lower production costs or higher barriers to entry, while others may have lower profit margins due to intense competition or high levels of regulation.

It is also important to consider the size of the company when comparing profit margins. Larger companies may have lower profit margins due to higher operating costs, while smaller companies may have higher profit margins due to lower overhead costs.

Overall, analyzing profit margin requires careful consideration of the context in which the profit margin was achieved, as well as an understanding of the unique characteristics of the industry and company in question. By interpreting profit margin results correctly and comparing them appropriately, companies can gain valuable insights into their financial performance and make informed decisions about future investments and strategies.

Improving Profit Margin

Strategies to Increase Sales

One of the most effective ways to improve profit margin is to increase sales revenue. This can be achieved through various strategies, such as:

Expanding the customer base: By reaching out to new customers, businesses can increase their sales revenue. This can be done through advertising, social media marketing, and other promotional activities.

Offering discounts and promotions: Offering discounts and promotions can attract new customers and encourage existing customers to buy more. However, businesses must be careful not to offer discounts that are too steep, as this can eat into their profit margin.

Improving product quality: By improving the quality of their products, businesses can increase customer satisfaction and loyalty, which can lead to higher sales revenue.

Cost Reduction Techniques

Another way to improve profit margin is to reduce costs. This can be achieved through various cost reduction techniques, such as:

Negotiating with suppliers: By negotiating with suppliers, businesses can reduce their cost of goods sold (COGS), which can increase their profit margin.

Reducing overhead costs: Overhead costs, such as rent, utilities, and salaries, can eat into a business's profit margin. By reducing these costs, businesses can increase their profit margin.

Streamlining operations: By streamlining their operations, businesses can reduce waste and improve efficiency, which can reduce costs and increase profit margin.

In conclusion, improving profit margin involves both increasing sales revenue and reducing costs. By implementing the strategies and techniques outlined above, businesses can improve their profit margin and achieve greater financial success.

Profit Margin Tools and Resources

Calculating profit margins can be a challenging task, but there are several tools and resources available to help businesses analyze their sales data and determine their profit margins. This section will explore some of the most popular software solutions and educational resources for profit margin analysis.

Software Solutions for Profit Margin Analysis

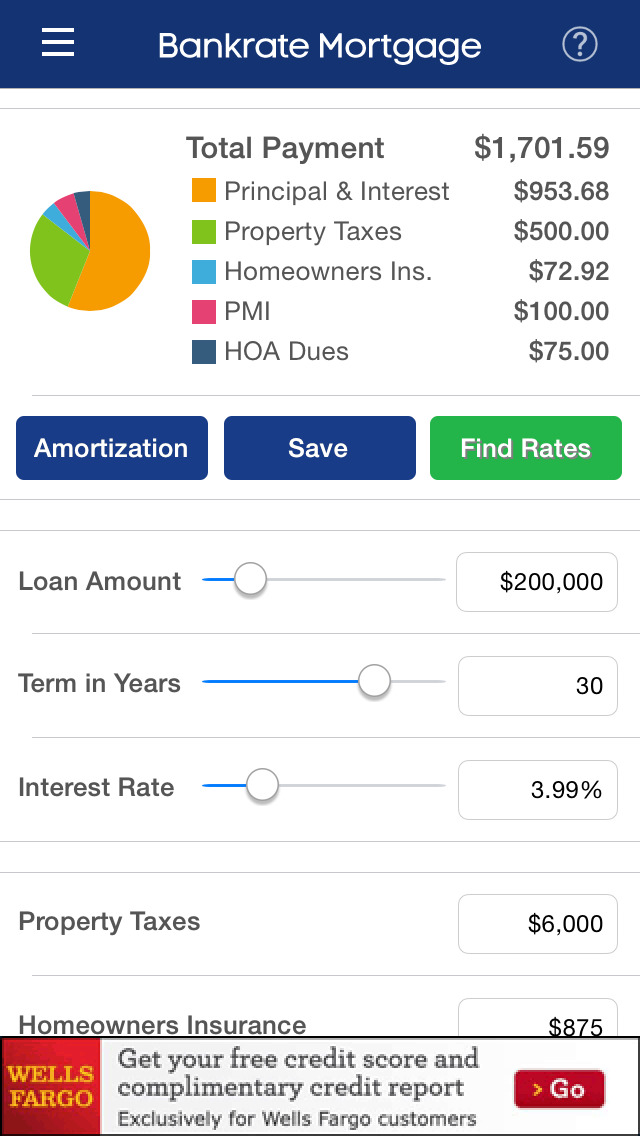

There are several software solutions available that can help businesses calculate their profit margins quickly and accurately. One popular option is Bench Accounting's Profit Margin massachusetts mortgage calculator, which allows users to input their revenue and expenses and receive an instant calculation of their profit margin. This tool is easy to use and can be accessed online for free.

Another popular software solution is QuickBooks, which offers a variety of accounting tools including profit margin analysis. QuickBooks allows users to track their sales data and expenses, and provides detailed reports on their profit margins. This tool is ideal for businesses of all sizes and can be accessed online or through a desktop application.

Educational Resources for Further Learning

In addition to software solutions, there are also several educational resources available for businesses looking to learn more about profit margin analysis. Investopedia offers a comprehensive guide on how to calculate profit margins, including step-by-step instructions and examples. This resource is ideal for businesses looking to gain a deeper understanding of profit margin analysis.

Another valuable resource is the Small Business Administration's (SBA) website, which offers a variety of articles and guides on financial analysis and management. The SBA's resources are free to access and cover a wide range of topics, including profit margin analysis and financial forecasting.

Overall, there are many tools and resources available to help businesses calculate their profit margins and gain a deeper understanding of their financial performance. By utilizing these resources, businesses can make informed decisions and improve their bottom line.

Frequently Asked Questions

How do you determine the profit margin from the selling price and cost?

To determine the profit margin from the selling price and cost, you need to subtract the cost from the selling price and divide the result by the selling price. Then, multiply the result by 100 to get the percentage profit margin. The formula for calculating profit margin is:

Profit Margin = (Selling Price - Cost) / Selling Price x 100%

What steps are involved in calculating the profit percentage?

To calculate the profit percentage, you need to divide the profit by the selling price and multiply the result by 100. The formula for calculating profit percentage is:

Profit Percentage = Profit / Selling Price x 100%

How can you calculate profit margin using Excel?

To calculate profit margin using Excel, you can use the following formula:

= (Selling Price - Cost) / Selling Price

Then, format the result as a percentage. This will give you the profit margin as a percentage.

What is the process for calculating profit margin per unit sold?

To calculate profit margin per unit sold, you need to subtract the cost per unit from the selling price per unit and divide the result by the selling price per unit. Then, multiply the result by 100 to get the percentage profit margin per unit sold. The formula for calculating profit margin per unit sold is:

Profit Margin Per Unit Sold = (Selling Price Per Unit - Cost Per Unit) / Selling Price Per Unit x 100%

Can you explain how to compute a 20% profit margin on sales?

To compute a 20% profit margin on sales, you need to determine the cost of goods sold and the selling price. Once you have these figures, you can use the following formula to calculate the selling price:

Selling Price = Cost / (1 - Profit Margin)

If you want a 20% profit margin, then you would substitute 0.20 for Profit Margin in the formula. For example, if the cost is $100, then the selling price would be:

Selling Price = $100 / (1 - 0.20) = $125

Is there a difference between sales margin and profit margin, and how are they calculated?

Yes, there is a difference between sales margin and profit margin. Sales margin is the percentage of the selling price that represents profit, while profit margin is the percentage of the selling price that represents profit after all expenses have been subtracted.

To calculate the sales margin, you need to subtract the cost from the selling price and divide the result by the selling price. Then, multiply the result by 100 to get the percentage sales margin. The formula for calculating sales margin is:

Sales Margin = (Selling Price - Cost) / Selling Price x 100%

To calculate the profit margin, you need to subtract all expenses, including the cost of goods sold, from the selling price. Then, divide the result by the selling price and multiply the result by 100 to get the percentage profit margin. The formula for calculating profit margin is:

Profit Margin = (Selling Price - Expenses) / Selling Price x 100%