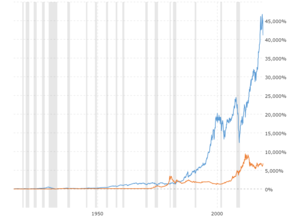

4) As an inflation hedge, and as explored in Chapter 16 (link right here), gold is behaving precisely as anticipated, and experiencing asset inflation in inflation-adjusted phrases as market expectations of disaster are rising, which unlocks much more upside potential than would exist if gold had been a mere stable store of worth. Since 1 gram gold coins, bars and rounds are dearer to supply, additionally they usually command higher premiums, which means the price one pays will be above and past the price for the mere weight of gold. There may be a wide range of gradings for these coins, from Circulated Condition as much as MS-65, MS-sixty six and/or MS-67 gradings. In relation to evaluating gold prices in coins, the numismatic worth and/or collectible value of the gold coin should be accounted for. Silver’s worth tends to be more influenced by industrial demand, on account of the many functions for which it's used (and used up, in order that it should be changed). The worth of gold will change every day because it's connected to so many interrelated market determinants, including investment follow, hypothesis price, supply, demand, foreign money analysis, and socio-economic elements.

4) As an inflation hedge, and as explored in Chapter 16 (link right here), gold is behaving precisely as anticipated, and experiencing asset inflation in inflation-adjusted phrases as market expectations of disaster are rising, which unlocks much more upside potential than would exist if gold had been a mere stable store of worth. Since 1 gram gold coins, bars and rounds are dearer to supply, additionally they usually command higher premiums, which means the price one pays will be above and past the price for the mere weight of gold. There may be a wide range of gradings for these coins, from Circulated Condition as much as MS-65, MS-sixty six and/or MS-67 gradings. In relation to evaluating gold prices in coins, the numismatic worth and/or collectible value of the gold coin should be accounted for. Silver’s worth tends to be more influenced by industrial demand, on account of the many functions for which it's used (and used up, in order that it should be changed). The worth of gold will change every day because it's connected to so many interrelated market determinants, including investment follow, hypothesis price, supply, demand, foreign money analysis, and socio-economic elements.

You’ll actually pay the identical no matter your market. Inflation is when costs rise, and by the identical token, prices rise as the worth of the dollar falls. That makes the latest uptrend in gold a bit bit strange, says Ford O'Neill, co-portfolio supervisor at the Fidelity Strategic Real Return Fund, a mutual fund strategy centered on shielding traders from inflation danger. Many buyers see an immutable, intrinsic worth in gold tied to its utility and its unique physical properties, together with its magnificence and its softness. Considered a "protected haven" asset, the money worth for gold also goes up when the actual worth of currencies, together with the US greenback, the UK pound, and the Euro goes down. The Federal Reserve has been aggressively raising curiosity rates for over a year in its ongoing battle to bring down inflation. This achieve was virtually 5X larger for gold than properties, and was sufficient to maneuver the ratio in a single year from 162 ounces of gold to buy a house, all the way down to 136 ounces. There are also many such as the SPDR Gold Shares (GLD) that let investors purchase and sell gold without ever having to bodily own the precise valuable steel.

You’ll actually pay the identical no matter your market. Inflation is when costs rise, and by the identical token, prices rise as the worth of the dollar falls. That makes the latest uptrend in gold a bit bit strange, says Ford O'Neill, co-portfolio supervisor at the Fidelity Strategic Real Return Fund, a mutual fund strategy centered on shielding traders from inflation danger. Many buyers see an immutable, intrinsic worth in gold tied to its utility and its unique physical properties, together with its magnificence and its softness. Considered a "protected haven" asset, the money worth for gold also goes up when the actual worth of currencies, together with the US greenback, the UK pound, and the Euro goes down. The Federal Reserve has been aggressively raising curiosity rates for over a year in its ongoing battle to bring down inflation. This achieve was virtually 5X larger for gold than properties, and was sufficient to maneuver the ratio in a single year from 162 ounces of gold to buy a house, all the way down to 136 ounces. There are also many such as the SPDR Gold Shares (GLD) that let investors purchase and sell gold without ever having to bodily own the precise valuable steel.

Be conscious of each day gold prices and buy your gold when your gold value target is hit. Monitor the live gold price conveniently and effectively with our reside gold prices graphs. Monitor the reside spot gold worth right now on our webpage to achieve the very best perception into future gold market trends. Monitor the dwell worth of gold with our gold price chart information and absorb insights into past gold value tendencies in addition to potential future prices of gold. Over the past 5 years, the peak gold value came on August 6, 2020 at which level the value of gold was $2756.00 CAD per oz. You too can consult our reside gold value chart to see when the worth of gold per ounce was at its highest. In Australian dollar phrases, the price of the valuable metal has soared more than 20 per cent this year, sitting above $3,700 an ounce. These assumptions have been influenced by the reduction of global inflation worries and efforts by main central banks to avert a extra complete monetary crisis.

Amidst the everything bubble, rising interest rates, Israel and Palestine tensions, KA***Rin.E.Morgan823 lockdown protocols, the after-effects of Brexit, and high tensions leading to the Russian-Ukrainian struggle, gold prices elevated by round 18% from their value at first of the year as buyers had been on the lookout for low-danger investments. Typically, though, when curiosity charges rise, it indicators that the economic system is powerful. Still, preserving according to the much-scrutinized economic weirdness of the previous half-decade, gold has stayed lofty even because the economic system booms, curiosity charges largely remain high, shopper sentiment improves dramatically, and the dollar’s muscular worth prevails. The gold-to-silver ratio, which reached its widest spread in September 2022, has since narrowed to around 80 and is expected to drop further to 70 if the Fed cuts charges and the US economic system stays resilient. So buyers should not be too concerned if there's a short lived drop in gold prices. In consequence, investors are actually focusing on important US PCE information and statements from various Federal Reserve authorities to gain perception into the Fed’s future choices. When the stock market becomes too over-valued and warning indicators of an impending crash begin flashing, nervous traders trying to earn the utmost ROI from their inventory portfolio start pulling out their belongings in vast numbers, sensing their patiently-earned positive factors could quickly vanish.